Donate

Donate

Donate

Donate

Surplus

Deductions

Total amount subject to Khums $0

Khums Due $0

Sahm al Imam to be paid $0

Sahm al Sada to be paid $0

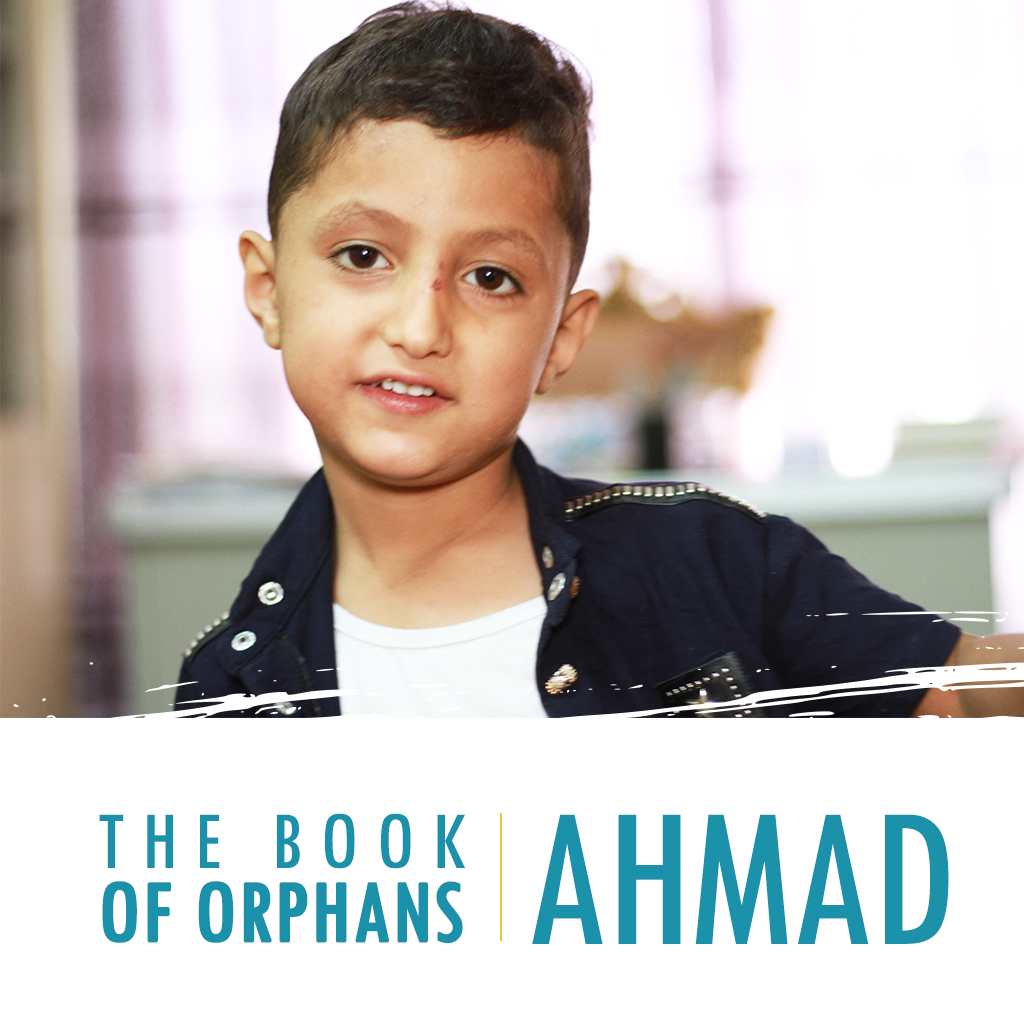

Over the last several months, we have shared many stories of children orphaned by war and terrorism. These stories spoke of trauma, loss, and recovery. War, however, is not the only reason these children experience such tragedies. At the height of a global opioid pandemic, we are reminded that no culture, society of faith is spared. At 9 years old, Ahmad witnessed how this disease deteriorated his family. His father struggled with addiction in an environment of war and economic hardship, he grew depressed with his inability to feed his addiction or rid himself of it. On his darkest day, he could no longer manage, Ahmad’s father walked into the kitchen, emptied a bottle of lighter fluid all over his clothes and lit himself on fire. Unfortunately, he did not survive.

Consequently, Ahmad and his sister were orphaned, this was a turning point in their lives and just the beginning of what was yet to come. Unfortunately, their mother was not able to secure employment due to the economic hardship the country was facing, and as a result, the family lost their home, forcing them to move in with their paternal grandparents. As the entire family tried to maneuver through feelings of loss, guilt, and grief, not everyone dealt with properly. The grandparents blamed the widow for their son’s addiction and suicide and consequently took it out on the children.

Thus, Ahmad and his sister were forced to suffer the consequences of their grandparent’s anger. They were not provided with a proper space to sleep and store their belongings, constantly kicked out of the house and forbidden from playing with whatever toys their cousins left lying around the house. This misplaced anger and their realization that their surviving parent could not protect or provide for them created deeply rooted psychological and mental issues among the children.

As a result, Ahmad began exhibiting signs of what would later be classified as bipolar depression. Fits of rage followed by long periods of self-imposed isolation became the norm. Months in and months out, the days began to blend together and Ahmad’s hopes and dreams disappeared.

Desperate to change the circumstances of her family, the mother heard about a new organization and their commitment to helping orphans. She met with representatives from the Al-Ayn Social Care Foundation and things began to slowly turn around for them. The family was finally able to move out of their grandparent’s home and into their own. Their freedom to roam, play and be children was no longer restricted. Above all, Ahmad began receiving the therapy he so desperately needed. Al-Ayn’s commitment to a wholesome approach is what ensured the survival of this family. Through housing assistance, monthly allowances and needed psychological assistance the family began and continues to recover.

Children are resilient and they are the future, it is incumbent upon us all to help secure that future by giving them the means to help them transcend and flourish.